Demystifying Forex Brokers: Essential Guide for Beginners

Are you a curious beginner ready to dive into the world of forex trading? Buckle up, because we’re about to demystify the enigmatic universe of forex brokers and arm you with all the essential knowledge you need! With its enormous potential for profit and intriguing complexities, foreign exchange trading can seem intimidating at first. But fear not; this ultimate guide is designed specifically for newcomers like yourself.

From unraveling industry jargon to understanding different broker types, we’ve got your back on this exhilarating journey toward becoming a successful forex trader. Let’s eliminate any confusion and get you started on the right track – it’s time to master everything about forex brokers in one go!

Table of Contents

Introduction to Forex Brokers

As a beginner in the Forex market, you may be wondering what exactly a Forex broker is and what role they play in the market. In simple terms, a Forex broker is an individual or firm that connects currency traders with liquidity providers to execute their trades.

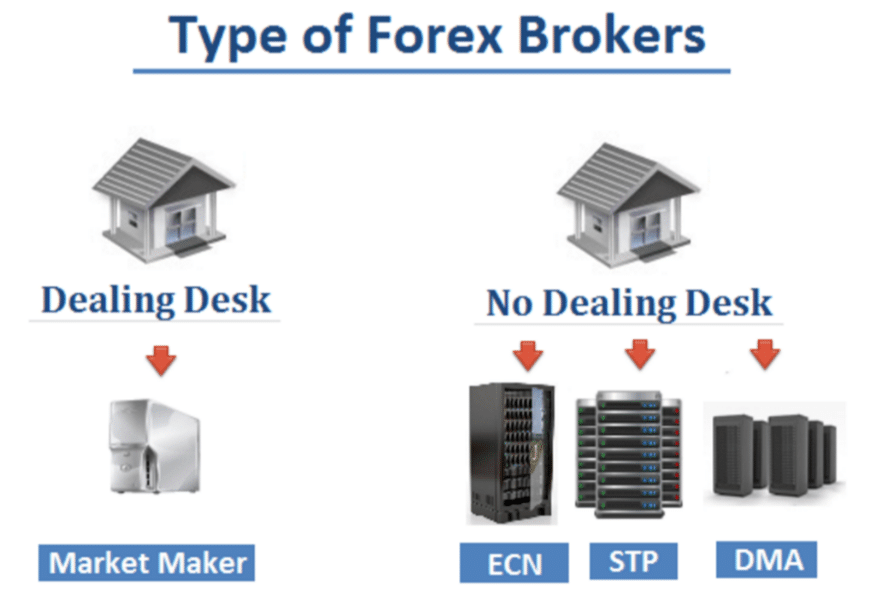

While there are many different types of Forex brokers available, they can typically be classified into two main categories: dealing desk (DD) brokers and non-dealing desk (NDD) brokers. Dealing desk brokers (also known as market makers) are those that provide their quotes and take the other side of your trade. Non-dealing desk brokers (ECNs) on the other hand, connect their clients directly to the interbank market.

Now that you have a better understanding of what Forex brokers are and what they do, it’s time to start shopping around for one that best suits your trading needs!

What Is a Forex Broker and What Do They Do?

When you’re ready to start trading forex, you’ll need to find a broker. A forex broker is a middleman who can help you buy and sell currencies. Forex brokers can provide you with access to the foreign exchange market and allow you to trade in multiple currencies.

Forex brokers usually charge a commission or fee for their services. They may also earn money from the spread, which is the difference between the bid and ask price of a currency pair.

When choosing a forex broker, it’s important to compare different providers to find one that best suits your trading needs. You’ll want to consider factors such as account fees, currency pairs offered, leverage, and customer service.

When you open an account, the broker will provide you with access to charts, trading tools, as well as user-friendly platforms for placing trades. Your broker can also provide advice and guidance when needed. Ultimately though, your success or failure in the forex market depends on your knowledge and skills.

Different Types of Forex Brokers

The foreign exchange (forex) market is one of the most exciting, fast-paced markets in the financial world. Though often shrouded in mystery, forex is simply the exchange of one currency for another.

The forex market is the largest and most liquid market in the world, with trillions of dollars traded every day between a vast network of central banks, commercial companies, currency speculators, and other financial institutions.

There are two main types of forex brokers: retail and institutional. Retail brokers cater to individual investors, while institutional brokers serve large banks and other financial institutions. Each type of broker has its strengths and weaknesses, so it’s important to understand the difference before choosing a broker.

Retail brokers

Retail brokers are typically regulated by the financial regulatory body in their country of operation. This provides some protection for investors against fraud or dishonest practices. Retail brokers usually offer many different types of accounts, including mini accounts for beginners with small deposits, standard accounts for more experienced investors, and managed accounts for those who want someone else to trade on their behalf.

.jpg)

Most retail brokers offer online trading platforms as well as mobile trading apps, making it easy to trade from anywhere in the world. Some also offer “Islamic” accounts which follow Shariah law and do not charge or pay interest (riba).

- Strengths: Regulated by financial authorities; provides protections for investors; offers multiple account types; easy to use online platforms; can trade from anywhere in the world.

- Weaknesses: Lack of market access; lack of personalized service; high minimum deposit requirements; high fees and commissions.

Institutional brokers

Institutional brokers typically serve large banks, hedge funds, and other financial companies. They provide users with access to sophisticated trading tools, deep liquidity, and low transaction costs. Institutional brokers often operate with more leniency than retail brokers when it comes to regulations. As institutional brokers cater to large clients they also offer much better customer service and personalized advice based on an in-depth understanding of the client’s strategy.

- Strengths: Access to deep liquidity; low transaction costs; sophisticated trading tools; personalized advice based on client’s strategy.

- Weaknesses: Lack of regulatory oversight; expensive accounts; limited access for individual traders.

Choosing the right forex broker depends on the individual investor’s needs. It is important to assess your own risk tolerance, investment goals, and trading experience before deciding which type of broker is best suited for you.

Advantages and Disadvantages of Using a Forex Broker

When engaging in forex trading, you will need to choose a broker to work with. A forex broker is an individual or firm that facilitates the buying and selling of currencies on the foreign exchange market. While you can trade currency pairs without a broker, using one offers several advantages and disadvantages.

Advantages

A forex broker can provide you with access to the large and highly liquid foreign exchange market. This is important because it allows you to take advantage of opportunities as they arise and buy or sell currencies at competitive rates.

A broker can also offer you leverage, which enables you to trade with more money than you have in your account. Leverage can help you make profits from even small movements in the market, but it also amplifies your losses so it should be used with caution.

Another advantage of using a broker is that they can provide you with tools and resources to help you make informed trading decisions. For example, most brokers offer charts and other technical analysis tools that can give you valuable insights into currency price movements.

Disadvantages

While working with a forex broker has many advantages, there are also some potential drawbacks to consider. One is that brokers typically charge commissions or fees for their services. This means that your profits will be reduced by the amount of commission you pay to your broker.

Another downside is that brokers may not always act in your best interests. For example, some brokers may trade against their clients or use the same strategies on all of their customers, which could reduce your chances of making a profit. Additionally, brokers typically have access to more information than individual traders, so they may be able to make better decisions than you can.

Things to Consider When Choosing a Forex Broker

When choosing a forex broker, there are several things you need to take into consideration to select the best one for your own trading needs and goals.

- Cost: Different brokers will charge different fees for their services. Some may be more expensive than others, so it’s important to compare costs before making a decision. Make sure you understand what all the fees are and whether they’re charged on a per-trade or monthly basis

- Leverage: Leverage allows you to trade with more money than you have in your account. This can help you make bigger profits, but it also comes with greater risk. Make sure you understand how leverage works before using it.

- Platforms and Tools: The best forex brokers will offer their clients access to powerful trading platforms and tools that can help them make informed decisions. Make sure the broker you choose offers a platform that suits your needs and gives you the information and analysis you need to trade effectively.

- Customer Support: When something goes wrong or you have questions about your account, you’ll want to be able to get help from customer support quickly and easily. Make sure the broker you choose has good customer support options that are available when you need them.

- Regulation: Make sure the broker you choose is regulated by a financial authority in your country or region. This will ensure that your money is protected in case of fraud or insolvency.

These are some of the most important factors to consider when selecting a forex broker. Do your research and make sure you understand what all the fees and terms involve before you commit to an account.

Regulations and Industry Supervision for Trading with Forex Brokers

If you’re new to the world of forex trading, one of the first things you need to understand is the regulatory environment in which your broker operates. Forex brokers are subject to strict regulations imposed by agencies such as the Commodity Futures Trading Commission (CFTC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom. These regulations establish standards for fair dealing, protect customer funds, and prohibit certain types of abusive practices.

ITobe allowed to operate in these jurisdictions, brokers must demonstrate that they have the financial resources and internal controls necessary to meet their obligations to customers. They must also submit to regular audits by these agencies. As a result of this stringent oversight, forex brokers operating in these jurisdictions are generally considered to be among the most reliable and trustworthy in the industry.

If you’re considering opening a forex account with a broker located in another country, it’s important to check what type of regulation, if any, they are subject to. Although some brokers may voluntarily submit to regulation by a foreign agency, this does not necessarily provide the same level of protection as would be afforded by a local regulator.

In addition, it can be difficult or impossible to take legal action against a foreign broker if they engage in fraudulent or dishonest practices. For these reasons, it’s generally advisable to choose a broker that is regulated by a major agency in your own country.

Benefits of Trading With A Reputable Forex Broker

There are many benefits of trading with a reputable Forex broker. One of the most important is that they can provide you with access to the best currency exchange rates. This means that you can save money on your transactions, as well as get the most out of your investment.

Another benefit of working with a reputable Forex broker is that they can offer you leverage. Leverage allows you to trade with more money than you have in your account. This can be a great way to increase your profits, but it also comes with risk. Be sure to understand the risks before using leverage.

A reputable Forex broker will also have good customer service. This means that if you have any questions or concerns, they will be able to help you quickly and easily. They should also have a user-friendly platform so that you can easily navigate their website and find the information that you need.

When choosing a Forex broker, be sure to research them thoroughly. There are many scam artists out there who are looking to take advantage of unsuspecting investors. By taking the time to find a reputable broker, you can avoid these pitfalls and make the most out of your investment.

Conclusion

With this article, we have tried to demystify forex trading by providing an essential guide for beginners. We hope that you have found the tips and advice here valuable in finding a suitable broker. Before making any decisions about forex brokers, make sure to do your research first so that you can find the best relationship for your needs – whether it be the lowest cost or access to specific markets and assets. By doing so, you can be sure to get started with confidence on your path toward successful trading!