Understanding the Concept of Hedging in Forex and Its Significance

Welcome to our blog post on the fascinating world of hedging in Forex! If you’ve ever wondered how experienced traders manage to protect their investments and minimize risks, then this is a topic you definitely don’t want to miss. Understanding the concept of hedging in forex can be your key to successful trading, allowing you to navigate volatile markets with confidence.

Join us as we dive deep into the intricacies of hedging in forex and explore its significant role in safeguarding your financial interests. Get ready to unlock the secrets of this powerful strategy that professionals rely on – so let’s jump right in!

Table of Contents

What is Hedging in Forex?

Hedging is a common term used in the financial world and it refers to the process of mitigating risk. Hedging in forex refers to the process of protecting oneself from potential losses that may occur due to fluctuations in currency rates. For example, if you are holding a large sum of money in EUR/USD, you may want to consider hedging your position to protect yourself from a potential drop in the value of EUR/USD.

There are two main types of hedging strategies that investors use in forex: short-term and long-term. Short-term hedging strategies are typically used to protect against potential losses that may occur over a short period of time, such as a few days or weeks. On the other hand, long-term hedging strategies are designed to mitigate risk over a longer period of time, such as months or years.

Hedging in the forex market can be an effective way to limit your risk exposure. However, it is important to remember that no hedging strategy is perfect and there is always the potential for loss. Before implementing any hedging strategy, it is important to understand all of the risks involved and consult with a financial advisor.

How Does Hedging Work in the Forex Market?

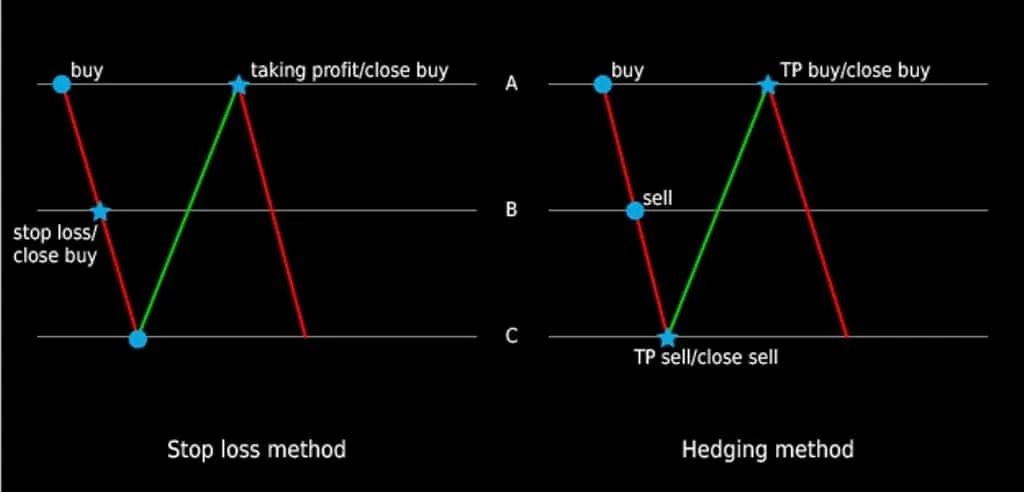

Hedging in forex is a strategy that is used to protect against currency risk. By using this strategy, investors can buy and sell different currencies to take advantage of price differences. This way, they can minimize their losses if the market moves against them.

There are two main types of hedges: short hedges and long hedges. Short Hedges are used when an investor believes that the value of a currency will fall in the future, and thus buys another currency to offset the loss.

For example, if an investor believes that the value of the US dollar will fall against the euro, he might hedge his USD position by buying EUR. Long Hedges are used when an investor believes that the value of a currency will rise in the future. For example, if an investor believes that the value of GBP will increase against USD, he might hedge his GBP position by buying USD.

To put it simply, hedging in forex is a way for investors to protect themselves from losing money due to sudden changes in the forex market. By using this strategy, they can minimize their losses and maximize their profits.

Ultimately, hedging in the forex market is a way for investors to reduce their risk and manage their currency exposure.

Types of Hedging Strategies

There are four primary types of hedging strategies:

- Passive Hedging: This strategy involves placing trades that will offset the potential losses from your other positions. For example, if you have a long job in EUR/USD, you might take a short position in USD/CHF to hedge your risk.

- Active Hedging: This strategy is more aggressive and involves taking trades that are designed to profit from market moves in either direction. For example, if you think EUR/USD is going to fall, you might place a short trade and a long trade in USD/CHF at the same time.

- Futures Hedging: This strategy involves using futures contracts to offset the risk in your other positions. For example, if you have a long position in EUR/USD, you might purchase a futures contract for USD/CHF to hedge your risk.

- Options Hedging: This strategy involves using options contracts to protect against potential losses in your other positions. For example, if you have a long position in EUR/USD, you might purchase a put option on USD/CHF to hedge your risk.

No matter which strategy of hedging in forex you choose to use, the important thing is to understand how your positions are affected by changes in the market and have a plan to adjust accordingly.

Benefits of Hedging Strategies

Hedging strategies provide a number of benefits for forex traders:

- Reduced Risk: Hedging in forex can help reduce the risk of losses associated with market movements, as it allows traders to take a position that will benefit from both positive and negative shifts in the price of currencies.

- Improved Performance: By taking an opposite position to their main trade, traders can potentially benefit from both directions in the market, thereby improving their overall performance.

- Market Insights: By tracking positions taken by other traders, hedging strategies can provide insights into market trends and help investors make informed decisions on when to enter and exit trades.

- Profit Protection: By protecting profits through hedging strategies, traders can safeguard their gains from any sudden price changes in the currency markets.

- Increased Flexibility: Hedging strategies can be used to open up new trading opportunities and increase the flexibility of an overall trading strategy.

- Leveraged Positions: Hedging in forex can also be used to gain market exposure through leveraged trading positions, allowing traders to increase their potential gains.

Disadvantages of Hedging

Hedging in forex can be a powerful tool to protect your portfolio from downside risk, but it also has some potential drawbacks that investors should be aware of.

- Hedging in forex can add complexity and cost to your investment strategy. If you use derivatives or other complex financial instruments to hedge your position, you may incur additional fees and expenses. This can eat into your profits if the underlying investment doesn’t perform as well as expected.

- It can also limit your upside potential if the market moves in the opposite direction of your hedge. If you’re hedged against a decline in stock prices, for example, you won’t be able to benefit from any gains in the market.

- Hedging in forex can create a false sense of security. Just because you have a hedge in place doesn’t mean there’s no risk involved. Hedges are not perfect and they can sometimes fail to completely offset losses.

- It can lead to over-diversification and lower overall returns. If you hedge too much of your portfolio, you may end up owning a lot of different investments that offset each other’s gains and losses. This can make it difficult to generate meaningful profits.

Hedging may not be available when you need it most. Some markets are very volatile and may not offer good opportunities for hedging. In addition, some types of securities are not well suited for hedging

When to Use Hedging Strategies

Hedging is a risk management technique that is used in order to offset or minimize the potential loss from an adverse price movement in a security. In the financial markets, hedging is often accomplished by taking an offsetting position in a related security, such as buying put options to hedge against a decline in the price of the underlying stock.

There are a number of different circumstances where hedging may be appropriate. For example, if you are holding a long position in a stock that you believe will rise in value, but you are concerned about a potential short-term decline in the stock’s price, you could buy put options to protect your position. Or, if you are holding a bond that is about to mature and you are worried about interest rates rising before your bond matures, you could buy Treasury futures to hedge your position.

The key thing to remember when using hedging strategies is that they are designed to mitigate risk, not eliminate it. While hedging can help reduce the potential for losses, it can also limit the upside potential of your investment. As such, it is important to carefully consider whether or not hedging is right for you given your specific investment goals and objectives.

How to Implement a Hedging Strategy?

A hedging strategy is an important part of any forex trading plan. It can help you minimize your losses and protect your profits. But how do you implement a hedging strategy?

There are a few different ways to hedge your positions in forex. The most common is to use currency futures contracts. These contracts allow you to lock in a rate for a set period of time, so you know exactly how much foreign currency you will get when you need it.

You can also use options to hedge your positions. Options give you the right, but not the obligation, to buy or sell currency at a certain price. This gives you some flexibility if the market moves against you.

Another way to hedge is to use multiple currencies in your account. This diversifies your risk and can help offset any losses in one currency with gains in another.

Whatever method you choose, be sure to test it out before putting real money on the line. And remember, hedging is not a perfect science. There is always some risk involved. But if done correctly, it can help limit your losses and maximize your profits.

Conclusion

In conclusion, hedging in forex is a valuable tool that can protect your investments from potential losses. It can be difficult to understand at first, but with a bit of practice and help from experienced investors, it is possible to reap the rewards of hedging. Doing your research on the best strategies for using hedging in forex trading will ensure maximum success when you start investing. With proper adherence to reliable principles and systems, you should begin seeing results soon enough!